MIJNAOV, COMPLETELY DIGITAL

The application of an income protection insurance does not have to be unclear and slow. That’s why MijnAOV offers insight in the information that is necessary to apply, accept, mutate and claim. MijnAOV provides insight about the status and the course of the process to all parties, 24/7.

If the insured client becomes incapable at work, he wants to recover quickly and wants to do everything he wants again as soon as possible. The period of incapability is filled with insecurities, that’s why we think it is important that the client doesn’t have to worry about one more thing: with MijnAOV the claim is handled smoothly and swiftly.

MijnAOV:

%

The process is 100% digital

Digital applications and claims processed successfully

MIJNAOV HELPS

ONLINE PROCESS, ACTIVE INVOLVEMENT OF THE CLIENT AND PRIVACY PROTECTION

With MijnAOV.com the client is actively involved in application, acceptance and mutations of income protection insurances. When filing an income protection claim, the client is also informed about the expected compensation and the progress. The system works quick and thorough, with excellent protection of personal information. MijnAOV offers direct insight in the progress to the client, financial advisor and insurer on MijnAOV.com.

An online process with personal attention. By reducing administrative tasks more time is left to spent on personal contact! During the application, acceptation and mutation of the policy, but also during recovery, the client is actively assisted and informed about every step of the process. This creates clarity for all parties involved.

24/7 INSIGHT IN THE STATUS OF APPLICATION OR CLAIM

Personal data are well protected.

Active involvement of the client and direct feedback from the insurer.

Transparent, quick, 24/7 accessible and safe.

Insight and increased customer satisfaction for all parties.

OUR CUSTOMERS ARE SATISFIED

The rise of the internet and online services has changed the expectations of clients tremendously. Transparency, speed and involvement in important issues are part at the top of the wish list. Only a few organizations from the ‘old economy’ are able to cater to these expectations. By using MijnAOV it is possible to cater to these expectations without major interventions in the existing automation and client processes.

MijnAOV offers a front office where all parties involved come together in a shared workplace. A safe environment where personal information is secured and only authorized people get access.

MijnAOV offers permanent insight in the status of the application or claim. This reduces insecurity and confusion, and increases customer satisfaction.

THE MIJNAOV PROCESS

The client has contact with the financial advisor about an offer and receives a MijnAOV.com link for the application.

The client receives access to the application or claim and enters the requested information and health statement.

The insurer reviews the application and keeps the client up to date about the acceptation automatically.

If a claim occurs, MijnAOV supports the claim process from start to payment. The insurer offers personal assistance during recovery and offers insight in the progress on MijnAOV.com.

THE MIJNAOV TEAM

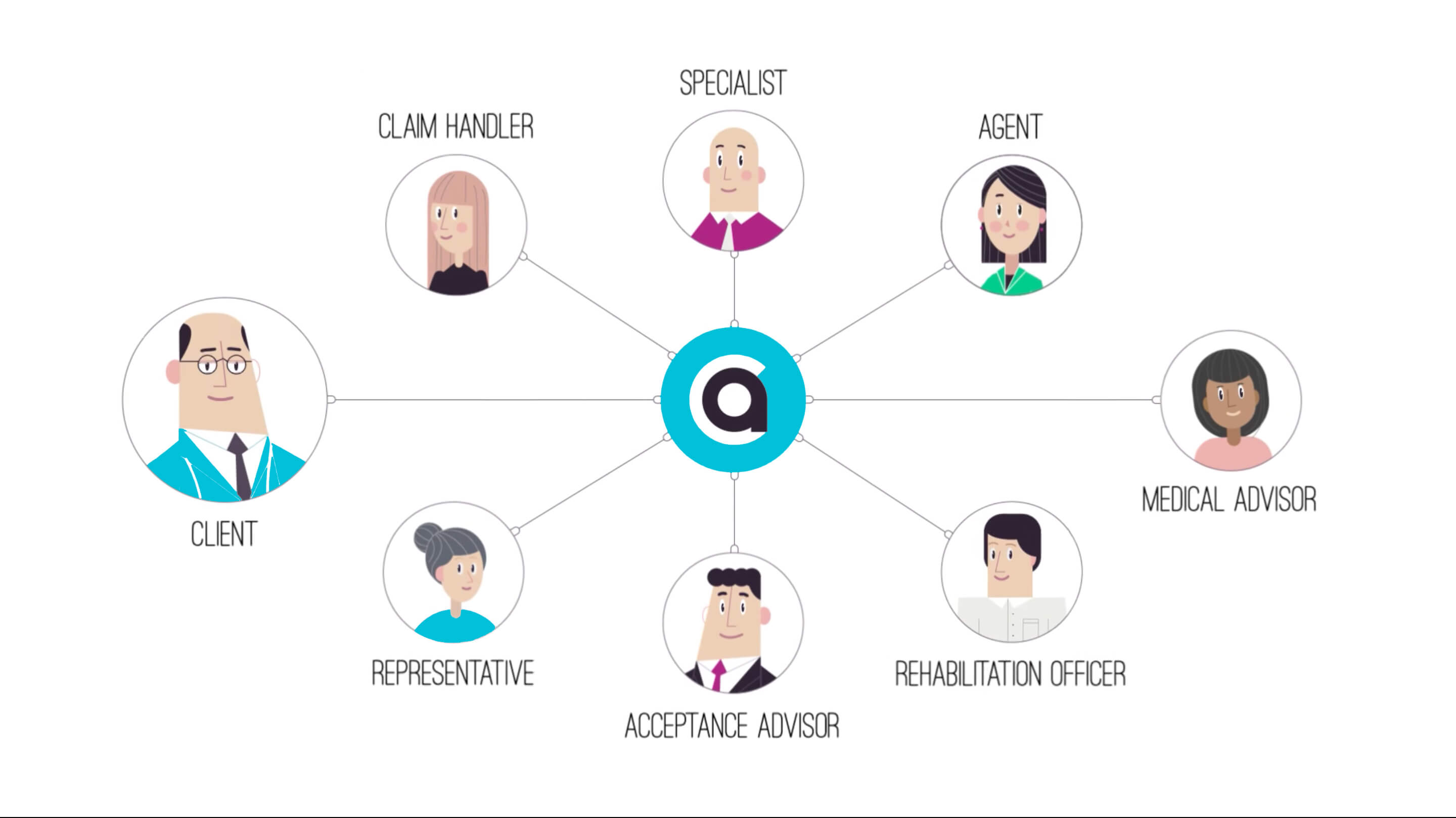

During the application for an insurance, but also when a client becomes incapable for work, personal contact is very important. The AOV team works together to help and guide the client.

The financial advisor plays an important role in the application process and will advise about the possibilities until the moment that the insurance is accepted. Via MijnAOV.com the client stays up to date about the progress of application and acceptation.

In case of work incapability, the client can report and follow the claim in MijnAOV. The claim advisor plays an important role in coaching the recovery and timely payments.

There are many experts involved with application, acceptation and claims. Only experts who are authorized receive access to the information they need in order to do their job. No more than necessary. This is how the privacy of the client is protected and how we comply to the security requirements of personal information. All data and documents stay within the secured walls of MijnAOV.

The team makes sure that there is contact with the client on a regular basis to discuss the developments, this is supported by the MijnAOV system. The team provides a face for the platform.

The MijnAOV team consists of:

MIJNAOV BENEFITS

The client has an active role in the application, claim and mutation process.

Safe exchange of medical and personal information. All information in the digital safe.

Reduces administrative tasks by automation and single entries.

Financial advisor / insurer can support entering information through chats and screen sharing.

Client enters most information himself.

One transparent workplace for all stakeholders. Complete files that make sure that applications are complete when they are reviewed.

Compliant to the most stringent privacy and data security requirements.

Status of applications and claims is 24/7 up-to-date accessible for all parties.

Flexible and easy to adjust to wishes of the insurer.

Includes fraud indicators and a full audit trail.

More information?

Would you like to have more information about the MijnAOV platform?

Please contact us through the contact form below!

Error: Contact form not found.